Exploring Average Car Insurance Cost: Factors, Regional Variances, Strategies, and Trends

Starting off with the average car insurance cost, this introductory paragraph aims to provide a comprehensive overview of the various aspects that influence insurance pricing. From factors affecting costs to regional differences, strategies to lower expenses, and trends shaping the industry, this discussion covers it all.

Factors influencing average car insurance cost

When it comes to determining the cost of car insurance, several factors come into play. These factors can significantly impact the premiums you pay for your auto insurance coverage.

Age

Age is a crucial factor that insurance companies consider when calculating car insurance premiums. Younger drivers, especially teenagers, are often charged higher premiums due to their lack of driving experience and higher likelihood of being involved in accidents. On the other hand, older, more experienced drivers typically pay lower premiums.

Location

Where you live can also affect your car insurance costs. Urban areas with higher population densities and increased traffic congestion are associated with a higher risk of accidents and theft, leading to higher insurance premiums. Additionally, areas prone to severe weather conditions or high crime rates may also result in higher insurance costs.

Driving History

Your driving history plays a significant role in determining your car insurance rates. Drivers with a clean record and no history of accidents or traffic violations are considered lower risk and are rewarded with lower premiums. On the contrary, drivers with a history of accidents, speeding tickets, or DUI convictions are likely to face higher insurance costs.

Type of Vehicle

The type of vehicle you drive can impact your car insurance premiums as well. Insurance companies take into account factors such as the make and model of your car, its age, safety features, and likelihood of theft when calculating your rates.

Expensive or high-performance vehicles typically cost more to insure due to higher repair costs and increased risk of theft.

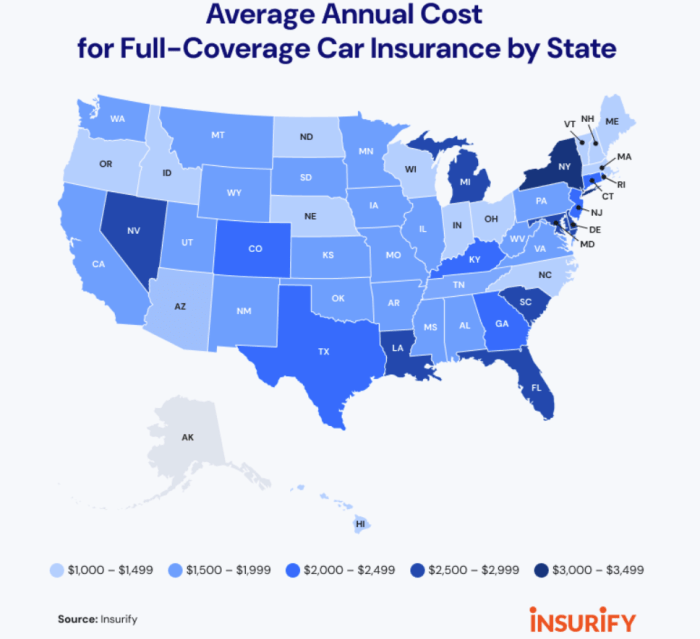

Regional differences in average car insurance cost

When it comes to car insurance, costs can vary significantly based on the region or state you live in. Factors such as population density, traffic congestion, and weather patterns can all influence insurance rates. Let's explore how these regional differences affect the average cost of car insurance.

Urban vs. Rural Areas

In general, urban areas tend to have higher car insurance rates compared to rural areas. This is because urban areas typically have higher population densities, which can lead to more accidents and higher rates of theft or vandalism. Additionally, urban areas often have more traffic congestion, increasing the likelihood of accidents.

Weather Patterns

Regions prone to extreme weather conditions, such as hurricanes, tornadoes, or heavy snowfall, may experience higher car insurance rates. These weather patterns can increase the risk of accidents and vehicle damage, leading insurance companies to adjust their rates accordingly.

State Regulations

Each state has its own set of regulations and requirements for car insurance, which can impact the average cost of coverage. Some states may require higher minimum coverage limits or have specific laws that affect insurance rates. It's important to consider these state-specific factors when comparing car insurance costs.

Competitive Markets

Competition among insurance providers can also influence regional differences in average car insurance costs. In areas with more insurance companies competing for business, consumers may have access to lower rates and better discounts. On the other hand, areas with fewer insurance options may see higher average costs.

Strategies to lower car insurance costs

When it comes to reducing your car insurance premiums, there are several strategies you can implement to save money. By taking proactive steps to qualify for discounts, choosing appropriate coverage levels, and improving your driving habits, you can lower your overall insurance costs.

Qualify for Discounts

- Consider bundling your auto insurance with other policies, such as homeowners or renters insurance, to receive a multi-policy discount.

- Ask your insurance provider about discounts for safe driving records, completing defensive driving courses, or being a member of certain organizations.

- Installing anti-theft devices or safety features in your vehicle can also help you qualify for discounts.

Choose Appropriate Coverage Levels

- Review your current coverage and assess whether you need all the optional add-ons. Dropping unnecessary coverage can help lower your premiums.

- Consider increasing your deductibles, but make sure you have enough savings to cover the higher out-of-pocket costs in case of an accident.

- If you have an older car, opting for liability coverage only instead of comprehensive and collision coverage can significantly reduce your insurance costs.

Improve Driving Habits

- Focus on maintaining a clean driving record by avoiding traffic violations and accidents, as this can lead to lower insurance rates over time.

- Consider enrolling in usage-based insurance programs that track your driving habits through telematics devices. Safe driving behaviors can result in discounts on your premiums.

- Drive less by carpooling, using public transportation, or walking whenever possible. Low mileage can qualify you for lower rates with some insurers.

Trends in average car insurance cost

Car insurance pricing is a dynamic landscape that is constantly evolving. Various factors contribute to the trends in average car insurance costs, impacting consumers in different ways.

Impact of Technology Advancements

Technology advancements in the automotive industry have influenced car insurance pricing trends. The integration of telematics devices, such as usage-based insurance programs, has allowed insurance companies to collect data on driving behavior. This data can be used to personalize insurance premiums based on individual driving habits, leading to potential cost savings for safer drivers.

Regulatory Changes

Regulatory changes at the state or federal level can also impact car insurance costs. For example, changes in minimum coverage requirements or legal frameworks can lead to adjustments in insurance premiums. Additionally, regulatory changes related to fraud prevention or consumer protection may influence pricing trends in the insurance market.

Economic Conditions

Economic conditions, such as inflation rates, unemployment levels, and overall market stability, can play a role in shaping car insurance pricing trends. During economic downturns, insurance companies may adjust their pricing strategies to mitigate financial risks, potentially leading to fluctuations in average insurance costs for consumers.

Final Review

In conclusion, the discussion on average car insurance cost delves into the intricate details that impact how much individuals pay for their coverage. By understanding the factors, regional variations, cost-saving strategies, and emerging trends, individuals can make informed decisions when it comes to their car insurance needs.

Commonly Asked Questions

What are some factors that influence car insurance cost?

Factors such as age, location, driving history, and type of vehicle can impact insurance premiums.

How do regional differences affect average car insurance cost?

Regional variations in population density, traffic congestion, and weather patterns can influence insurance rates.

What strategies can help lower car insurance costs?

Tips include qualifying for discounts, choosing appropriate coverage levels, and improving driving habits.

What are some recent trends in average car insurance cost?

Recent trends include advancements in technology, regulatory changes, and economic conditions impacting insurance pricing.