A Comprehensive Guide to Modified Car Insurance

Modified car insurance is a specialized type of coverage designed for vehicles that have been altered from their original factory specifications. From unique modifications to specific coverage considerations, this guide will delve into everything you need to know about insuring your modified car.

What is Modified Car Insurance?

Modified car insurance is a specialized type of auto insurance designed to cover vehicles that have been altered from their original factory specifications. These modifications can include changes to the engine, suspension, body kit, exhaust system, or any other components that enhance the performance or aesthetics of the vehicle.

Coverage Provided for Modified Vehicles

- Specialized Coverage: Modified car insurance provides coverage for the specific modifications made to the vehicle, ensuring that these enhancements are protected in case of damage or loss.

- Agreed Value: Instead of the actual cash value, modified car insurance policies often offer an agreed value that reflects the true worth of the modified vehicle.

- Custom Parts and Equipment: Coverage for custom parts and equipment that have been added to the vehicle, such as aftermarket rims, spoilers, or audio systems.

- Track Day Coverage: Some policies may offer coverage for track day events, which is typically excluded from standard car insurance policies.

Why Standard Car Insurance may not be Suitable for Modified Cars

- Underestimation of Value: Standard car insurance policies may undervalue the modifications made to the vehicle, resulting in insufficient coverage in case of a claim.

- Lack of Coverage for Custom Parts: Standard policies may not provide coverage for custom parts and equipment added to the vehicle, leaving owners at risk of significant financial loss.

- Increased Risk: Modified cars are often seen as higher risk by insurance companies due to the potential for increased performance, which may result in higher premiums or coverage exclusions.

- Legal Compliance: Certain modifications may not be legal or compliant with standard car insurance policies, making it necessary to have specialized coverage to ensure legal protection.

Types of Modifications Covered

When it comes to modified car insurance, different types of modifications can impact your coverage and premium rates. Here are some common vehicle modifications covered by modified car insurance, along with explanations on how they affect your policy:

Engine Modifications

- Performance enhancements like turbochargers, superchargers, and engine swaps are usually covered under modified car insurance.

- These modifications can increase your premium due to the higher risk of accidents or theft associated with high-performance engines.

- Engine modifications may also affect the coverage limits and terms of your policy, as insurers may consider them as higher risk factors.

Suspension and Brake Upgrades

- Lift kits, lowering kits, and upgraded brake systems are typically covered under modified car insurance.

- These modifications can impact your premium depending on the extent of the changes and the safety implications involved.

- Insurers may adjust coverage terms to reflect the increased risk of accidents or damages associated with modified suspension and brake systems.

Body Kits and Exterior Modifications

- Body kits, spoilers, and custom paint jobs are commonly covered by modified car insurance.

- Premium rates may vary based on the cost of the modifications and the likelihood of theft or vandalism related to flashy exterior changes.

- Insurers may consider these modifications when determining coverage limits and deductibles for your policy.

Finding the Right Policy

When it comes to insuring a modified car, finding the right policy is crucial to ensure adequate coverage and protection. Here are some tips to help you navigate the process and choose the best insurance company for your modified vehicle.

Factors to Consider

- Specialization: Look for insurance providers that specialize in covering modified vehicles. They will have a better understanding of the unique needs and risks associated with these cars.

- Customization Options: Ensure that the policy allows for customization to cover the specific modifications made to your car. This will help avoid any disputes in the event of a claim.

- Claims Process: Research the insurance company's claims process and reputation for handling claims related to modified cars. A smooth and efficient claims process is essential in times of need.

- Cost: Compare quotes from different insurance providers to find a policy that offers the right balance between coverage and affordability. Keep in mind that the cheapest option may not always provide adequate protection.

- Customer Reviews: Check online reviews and ratings of insurance companies that specialize in modified car insurance. Feedback from other policyholders can give you valuable insights into the company's reliability and customer service.

Comparison of Insurance Providers

| Insurance Company | Specialization | Customization Options | Claims Process | Cost | Customer Reviews |

|---|---|---|---|---|---|

| Company A | Yes | High | Efficient | Competitive | Positive |

| Company B | Yes | Medium | Average | Affordable | Mixed |

| Company C | No | Low | Slow | Cheap | Negative |

Cost Considerations

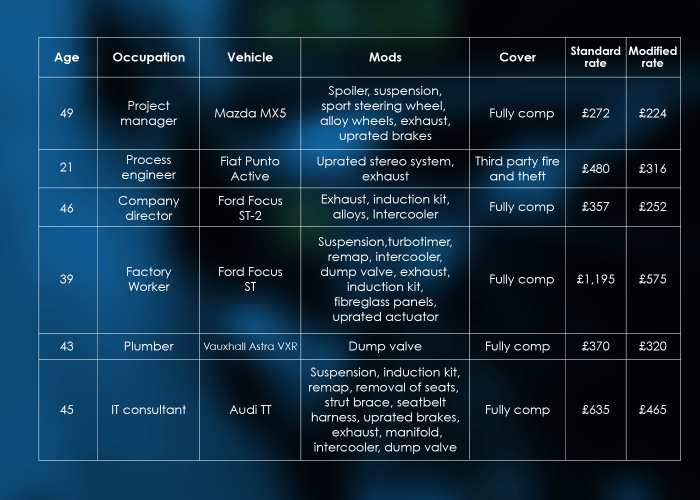

When it comes to insuring a modified car, the cost considerations can vary significantly from standard car insurance policies. The extent of modifications made to the vehicle and the overall value of the car are two key factors that heavily influence insurance costs.

Extent of Modifications and Insurance Costs

The more extensive the modifications on a car, the higher the insurance premium is likely to be. Performance enhancements, body modifications, and engine upgrades can all increase the risk factor in the eyes of insurance providers, leading to higher premiums.

Vehicle Value and Insurance Costs

The value of the modified car also plays a crucial role in determining insurance costs. Higher valued vehicles will naturally have higher premiums, as the insurance provider will need to cover a larger potential payout in case of damage or loss.

Cost-Saving Measures for Insuring a Modified Car

- Shop Around: Compare quotes from multiple insurance providers to find the best deal for your modified car.

- Join a Car Club: Some insurance companies offer discounts to members of recognized car clubs, so consider joining one to save on premiums.

- Security Measures: Installing security features like alarms, immobilizers, and tracking devices can help lower insurance costs by reducing the risk of theft.

- Agreed Value Policy: Opt for an agreed value policy where you and the insurer agree on the value of the car upfront, ensuring you receive the full amount in case of a total loss.

- Limited Mileage: If you don't drive your modified car frequently, consider a limited mileage policy to reduce premiums.

Final Review

In conclusion, navigating the world of modified car insurance requires a careful balance of understanding your vehicle's modifications, finding the right policy, and managing costs effectively. With the information provided in this guide, you're now equipped to make informed decisions and safeguard your modified car with the appropriate coverage.

FAQ Section

What factors determine the cost of modified car insurance?

The cost of modified car insurance is influenced by factors such as the extent of modifications, the vehicle's value, and the driver's history.

Can I insure aftermarket modifications with modified car insurance?

Yes, many insurance providers offering modified car insurance allow coverage for aftermarket modifications, but it's essential to disclose them accurately.

Is modified car insurance more expensive than standard car insurance?

Modified car insurance tends to be more expensive due to the increased risks associated with modified vehicles, but the cost can vary based on individual circumstances.