Understanding Medical Insurance Plans: A Comprehensive Guide

Medical insurance plans play a crucial role in ensuring individuals have access to necessary healthcare services without facing financial burdens. From coverage details to cost considerations, this guide delves into the intricacies of medical insurance plans, shedding light on important aspects that individuals need to know.

Overview of Medical Insurance Plans

Medical insurance plans are financial arrangements that provide coverage for medical expenses incurred by individuals. These plans help individuals mitigate the financial burden of unexpected healthcare costs by paying a portion or all of the medical bills, depending on the type of plan and coverage.Having medical insurance coverage is crucial as it offers financial protection and access to quality healthcare services.

Without insurance, individuals may have to pay for medical expenses out of pocket, leading to potential financial strain and limited access to necessary medical treatments.

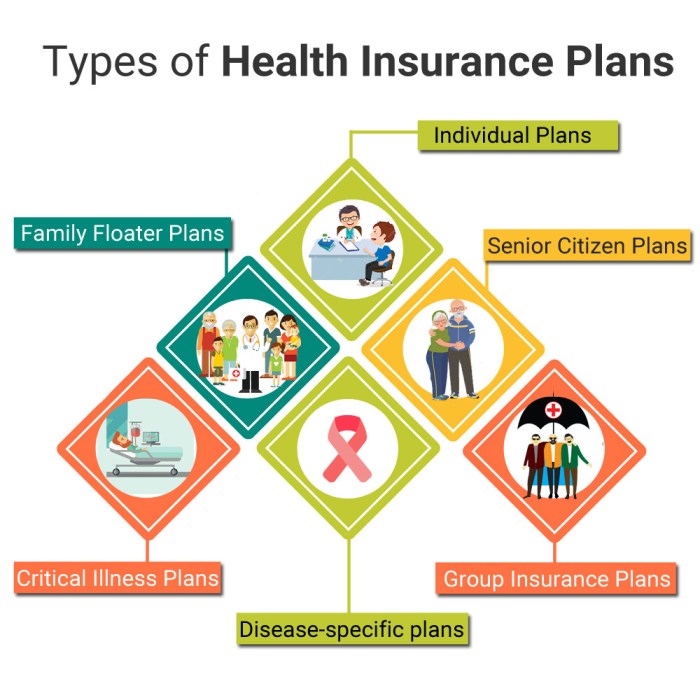

Types of Medical Insurance Plans

- Health Maintenance Organization (HMO): HMO plans require individuals to choose a primary care physician and obtain referrals for specialist visits. These plans often have lower out-of-pocket costs but limit the choice of healthcare providers.

- Preferred Provider Organization (PPO): PPO plans offer a network of healthcare providers, allowing individuals to visit in-network or out-of-network providers. While PPO plans provide greater flexibility, they usually come with higher premiums and out-of-pocket costs.

- Exclusive Provider Organization (EPO): EPO plans require individuals to use only in-network providers for coverage, except in cases of emergency. These plans typically have lower premiums and out-of-pocket costs compared to PPO plans.

- Point of Service (POS): POS plans combine features of HMO and PPO plans, requiring individuals to choose a primary care physician and providing coverage for out-of-network care with a referral. POS plans offer flexibility while maintaining cost control.

Coverage and Benefits

Medical insurance plans offer a variety of coverage options and benefits to help individuals manage their healthcare costs. These plans vary in terms of what services are covered and the level of financial protection they provide.

Coverage Provided by Medical Insurance Plans

- Hospitalization: Most medical insurance plans cover expenses related to hospital stays, including room and board, nursing care, and medications.

- Outpatient Care: Coverage for services received outside of a hospital setting, such as doctor's visits, lab tests, and diagnostic procedures.

- Prescription Drugs: Many plans include coverage for prescription medications, either through a formulary or a copayment system.

- Mental Health Services: Some plans offer coverage for mental health and substance abuse treatment, including therapy and counseling.

- Preventive Care: Coverage for preventive services like vaccinations, screenings, and wellness visits to help maintain overall health.

Common Benefits Included in Medical Insurance Plans

- Emergency Services: Coverage for emergency medical care, including ambulance services, emergency room visits, and urgent care.

- Maternity Care: Some plans provide coverage for prenatal care, childbirth, and postnatal care for expectant mothers.

- Rehabilitative Services: Coverage for physical therapy, occupational therapy, and other rehabilitative services to help individuals recover from injuries or surgeries.

- Dental and Vision Care: Some plans offer optional coverage for dental and vision services, including routine exams, cleanings, and eyeglasses.

- Hearing Aids: Coverage for hearing aids and related services for individuals with hearing loss.

Variation in Coverage Levels Among Medical Insurance Plans

Medical insurance plans can vary significantly in terms of coverage levels and benefits offered. Some plans may have higher deductibles and out-of-pocket costs but provide more extensive coverage for a wider range of services. Others may have lower premiums but offer more limited coverage and benefits.

It's important for individuals to carefully review and compare different plans to find one that best meets their healthcare needs and budget.

Cost and Premiums

When it comes to medical insurance plans, understanding the cost and premiums is essential for making informed decisions about your coverage. Premiums are the amount of money you pay to the insurance company in exchange for coverage. These premiums can vary based on factors such as your age, location, health status, and the type of plan you choose.

Factors influencing Premiums

- Age: Younger individuals typically pay lower premiums compared to older individuals.

- Health Status: Those with pre-existing conditions may have higher premiums.

- Location: Premiums can vary based on where you live due to differences in healthcare costs.

- Type of Plan: Comprehensive plans with more coverage often come with higher premiums.

Comparing Costs of Different Plans

There are various types of medical insurance plans available, each with its own costs and coverage options. It's important to compare these costs to find a plan that fits your budget and healthcare needs.

- Health Maintenance Organizations (HMOs): Typically have lower premiums but require you to use a network of providers.

- Preferred Provider Organizations (PPOs): Offer more flexibility in choosing healthcare providers but may have higher premiums.

- High Deductible Health Plans (HDHPs): Have lower premiums but higher deductibles, requiring you to pay more out of pocket before coverage kicks in.

Managing Plan Costs Effectively

There are strategies you can implement to help manage the costs of your medical insurance plan effectively:

- Utilize Preventive Services: Take advantage of free preventive services to avoid costly medical treatments down the line.

- Choose Generic Drugs: Opt for generic medications over brand-name drugs to save on prescription costs.

- Review In-Network Providers: Stick to in-network providers to avoid higher out-of-network costs.

- Consider Health Savings Accounts (HSAs): Contribute to an HSA to save for medical expenses tax-free.

In-Network vs. Out-of-Network Providers

When it comes to medical insurance plans, understanding the difference between in-network and out-of-network providers is crucial for policyholders to make informed decisions about their healthcare options.In-network providers are healthcare professionals, facilities, or hospitals that have a contract with a specific insurance company to provide services at a discounted rate.

On the other hand, out-of-network providers do not have a contract with the insurance company and may result in higher out-of-pocket costs for policyholders.

Impact on Costs for Policyholders

- When policyholders choose to use in-network providers, they typically pay lower co-pays, coinsurance, and deductibles compared to out-of-network providers.

- Out-of-network providers may bill policyholders for the difference between their charges and the amount covered by the insurance company, leading to unexpected and higher expenses.

- Using in-network providers can help policyholders maximize their insurance benefits and minimize their out-of-pocket costs.

Flexibility and Limitations

- Choosing in-network providers offers policyholders a more predictable and cost-effective healthcare experience, as they are covered under the insurance plan's negotiated rates.

- However, there may be limitations in terms of provider choices and availability when opting for in-network services, which could impact the ability to see specific healthcare professionals or visit certain facilities.

- On the other hand, out-of-network providers offer more flexibility in choosing healthcare providers but at the cost of potentially higher expenses for the policyholder.

Copayments, Deductibles, and Coinsurance

Copayments, deductibles, and coinsurance are essential terms to understand when it comes to medical insurance plans

Copayments

Copayments refer to the fixed amount that an individual pays for a covered healthcare service. This amount is typically due at the time of the service, such as a doctor's visit or prescription medication. Copayments can vary depending on the type of service or provider, and they are separate from any deductibles or coinsurance.

Deductibles

Deductibles are the amount that an individual must pay out of pocket before the insurance company starts covering a portion of the costs. For example, if you have a $1,000 deductible, you will need to pay the first $1,000 of covered services before your insurance kicks in.

Once the deductible is met, the insurance plan will then start sharing the costs with you through coinsurance or copayments.

Coinsurance

Coinsurance is the percentage of costs that an individual is responsible for paying after the deductible has been met. For instance, if your insurance plan has a 20% coinsurance rate, you will be responsible for paying 20% of the covered expenses, while the insurance company will cover the remaining 80%.

Coinsurance is typically applied after the deductible has been satisfied.Effective management of copayments, deductibles, and coinsurance involves understanding your plan's specifics and being prepared for potential out-of-pocket expenses. Here are some tips to help you navigate these factors effectively:

- Review your insurance plan documents carefully to understand the details of copayments, deductibles, and coinsurance.

- Budget for potential out-of-pocket costs based on your plan's structure and your healthcare needs.

- Take advantage of preventive care services that are often covered without cost-sharing to help minimize out-of-pocket expenses.

- Consider using in-network providers to maximize your insurance coverage and reduce costs.

- Keep track of your healthcare expenses throughout the year to monitor your progress towards meeting deductibles and managing coinsurance payments effectively.

Understanding and managing copayments, deductibles, and coinsurance can help you make informed decisions about your healthcare and finances while maximizing the benefits of your medical insurance plan.

Pre-Existing Conditions

Having a pre-existing condition can significantly impact how medical insurance plans handle coverage and premiums. These conditions refer to health issues that existed before the individual's enrollment in the insurance plan. It's essential to understand how pre-existing conditions are managed within the realm of medical insurance to navigate the options effectively.

Impact on Coverage and Premiums

Pre-existing conditions often lead to limitations in coverage or higher premiums in medical insurance plans. Insurance companies may exclude coverage for treatments related to pre-existing conditions for a certain period after enrollment, known as a waiting period. Additionally, individuals with pre-existing conditions may face higher premiums due to the increased risk they pose to insurance providers.

It's crucial to review the terms of the insurance plan regarding pre-existing conditions to understand the extent of coverage and associated costs.

Navigating Medical Insurance Plan Options

When selecting a medical insurance plan with a pre-existing condition, individuals should carefully compare different options to find the most suitable coverage. It's advisable to look for plans that offer comprehensive coverage for pre-existing conditions, even if it means higher premiums.

Additionally, individuals can explore special programs or state-specific insurance options designed to assist those with pre-existing conditions. Seeking guidance from insurance agents or healthcare professionals can also provide valuable insights into navigating medical insurance plan options effectively.

Employer-Sponsored vs. Individual Plans

Employer-sponsored medical insurance plans are typically provided by companies to their employees as part of their benefits package. On the other hand, individual plans are purchased directly by individuals from insurance companies or through the Health Insurance Marketplace.

Benefits and Limitations

Employer-Sponsored Plans:

- Benefits:

- Usually more affordable as employers often subsidize a portion of the premiums.

- May offer a wider range of coverage options.

- Group rates can result in lower costs.

- Limitations:

- Less flexibility to choose specific coverage options.

- Coverage ends when employment with the company ends.

- May not be portable if you change jobs.

Individual Plans:

- Benefits:

- More flexibility to choose specific coverage options.

- Portability – you can keep the plan even if you change jobs.

- May be tailored to individual needs.

- Limitations:

- Can be more expensive as you are responsible for the full premium.

- May have fewer coverage options compared to group plans.

- May require medical underwriting which could lead to higher premiums for individuals with pre-existing conditions.

Considerations for Choosing

When deciding between employer-sponsored and individual medical insurance plans, individuals should consider:

- Your budget and the cost of premiums.

- Your healthcare needs and those of your dependents.

- The level of coverage required for your specific medical conditions or treatments.

- Your job stability and the likelihood of changing employers in the near future.

- The availability of other coverage options, such as through a spouse's plan.

Epilogue

In conclusion, navigating the world of medical insurance plans can seem daunting at first, but armed with the right knowledge, individuals can make informed decisions that best suit their healthcare needs. Remember, having the right medical insurance coverage can provide peace of mind and financial security in times of need.

FAQs

What is the importance of having medical insurance coverage?

Medical insurance coverage ensures that individuals can access necessary healthcare services without facing exorbitant costs, providing financial security and peace of mind.

How are premiums determined in medical insurance plans?

Premiums in medical insurance plans are typically calculated based on factors such as age, health history, coverage level, and location.

What are copayments, deductibles, and coinsurance in medical insurance plans?

Copayments are fixed amounts paid by the insured at the time of service, deductibles are the amount individuals must pay before insurance kicks in, and coinsurance is the percentage of costs shared between the insured and the insurer.