Exploring the World of Self-Insurance

Embark on a journey into the realm of self-insurance, a practice that empowers individuals and businesses to take control of their financial security in a unique way. As we delve deeper, uncover the key aspects of self-insurance and discover how it differs from traditional insurance.

Learn about the benefits, risks, and considerations involved in self-insurance, and gain insights into setting up and managing a self-insurance plan effectively.

What is Self-Insurance?

Self-insurance is a risk management strategy where an individual or organization chooses to set aside funds to cover potential losses instead of purchasing traditional insurance policies. This means that the individual or organization will be responsible for paying out any claims that arise.

Examples of Industries or Individuals Practicing Self-Insurance

- Large corporations often practice self-insurance for certain aspects of their business, such as health insurance for employees or property damage.

- Some high net-worth individuals may choose to self-insure certain assets like expensive jewelry or art collections.

- Certain industries, like healthcare or transportation, may have self-insurance pools where multiple companies come together to cover potential losses collectively.

Benefits and Risks of Self-Insurance

- Benefits:

- Cost Savings: By self-insuring, individuals or organizations can potentially save money by avoiding insurance premiums.

- Customized Coverage: Self-insurance allows for more flexibility in designing coverage that meets specific needs.

- Investment Opportunities: Funds set aside for self-insurance can be invested, potentially earning returns over time.

- Risks:

- Financial Risk: Self-insuring means taking on the full financial risk of potential losses, which can be unpredictable and costly.

- Lack of Protection: Without traditional insurance, there may be gaps in coverage that could leave individuals or organizations vulnerable.

- Cash Flow Concerns: Large unexpected losses could strain cash reserves set aside for self-insurance.

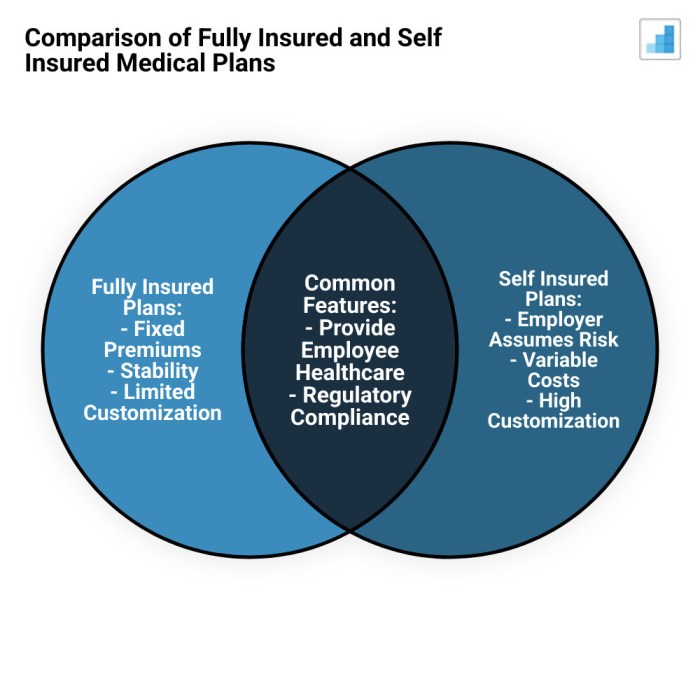

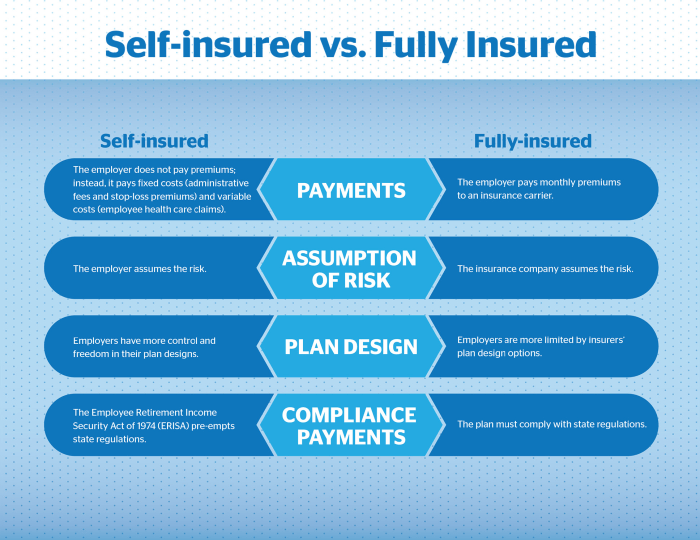

Self-Insurance vs. Traditional Insurance

Self-insurance and traditional insurance are two approaches to managing risk, but they differ in several key aspects such as cost, flexibility, and control.

Cost

- Self-insurance typically involves higher initial costs since the individual or organization assumes the risk themselves without transferring it to an insurance company.

- Traditional insurance requires regular premium payments to an insurance company, which can be less costly upfront but may add up to more over time.

- Self-insurance can be more cost-effective in the long run for those with low-risk profiles or financial stability to cover potential losses.

Flexibility

- Self-insurance offers more flexibility in customizing coverage and benefits according to specific needs, as there are no standard policy limitations.

- Traditional insurance policies come with predefined coverage options and limitations, limiting flexibility to tailor insurance to individual requirements.

- Self-insurance allows for adjustments in coverage levels or risk management strategies as needed, providing greater control over the insurance process.

Control

- Self-insurance provides greater control over claims processing, risk assessment, and fund management, as the individual or organization directly handles these aspects.

- Traditional insurance relies on the insurer to manage claims and make decisions, reducing the policyholder's control over the process.

- Self-insurance enables quicker response times to claims and more direct communication with involved parties, enhancing control over the insurance process.

In scenarios where an individual or organization has a strong risk management strategy, financial stability, and a good understanding of their risk exposure, self-insurance may be more beneficial than traditional insurance. This approach allows for tailored coverage, cost savings in the long term, and greater control over the insurance process.

Setting Up a Self-Insurance Plan

When it comes to setting up a self-insurance plan for a business, there are several important steps to consider. Self-insurance can offer cost savings and more control over the coverage provided, but it also comes with risks that need to be carefully managed.

Considerations for Self-Insuring

- Assess Risk: Before deciding to self-insure, it is crucial to assess the risks involved and determine if your business can handle potential large losses without traditional insurance coverage.

- Financial Stability: Ensure that your business has the financial stability to cover unexpected claims and losses that may arise.

- Regulatory Compliance: Understand the legal requirements and regulations in your industry related to self-insurance.

- Reinsurance Options: Consider purchasing reinsurance to protect against catastrophic losses that could exceed your self-insurance limits.

Tips for Managing a Self-Insurance Plan

- Establish Clear Policies: Create clear guidelines for claims handling, risk management, and other aspects of your self-insurance plan to ensure consistency and efficiency.

- Monitor Claims Closely: Keep a close eye on claims activity and trends to identify any potential issues early and take proactive measures to address them.

- Regular Reviews: Conduct regular reviews of your self-insurance plan to assess its effectiveness, make any necessary adjustments, and ensure compliance with regulations.

- Employee Education: Educate employees about the self-insurance plan, their responsibilities, and the importance of risk management to help prevent losses.

Self-Insurance Fundamentals

Self-insurance funds are a key component of self-insurance plans, allowing organizations to cover their own risks instead of purchasing traditional insurance from external providers. These funds are structured and managed in a specific way to ensure financial stability and security.

Components of a Self-Insurance Fund

Self-insurance funds typically consist of two main components: the claims reserve and the administrative fund. The claims reserve is set aside to cover potential losses or claims that may arise, while the administrative fund covers the day-to-day operational costs of managing the self-insurance plan.

- Claims Reserve: This portion of the fund is crucial for ensuring that there are enough funds available to cover any unexpected claims or liabilities. It acts as a safety net to protect the organization from financial strain in case of a large payout.

- Administrative Fund: This fund is used to cover the administrative costs associated with managing the self-insurance plan, such as staffing, legal fees, and other operational expenses.

Structure and Management of Self-Insurance Funds

Self-insurance funds are typically structured in a way that allows for easy access to funds when needed, while also ensuring long-term financial sustainability. These funds are often managed by a dedicated team or third-party administrator who oversees the day-to-day operations and financial health of the fund.

- Investment Strategy: Self-insurance funds may be invested in low-risk, liquid assets to ensure that funds are readily available in case of a claim. A well-defined investment strategy is crucial for maximizing returns while minimizing risk.

- Financial Reporting: Regular financial reporting and audits are essential to monitor the performance of the self-insurance fund and ensure compliance with regulatory requirements.

Risk Assessment and Reserve Funds in Self-Insurance

Risk assessment is a critical aspect of self-insurance, as it helps organizations identify potential risks and liabilities that need to be covered by the self-insurance fund. By conducting a thorough risk assessment, organizations can determine the appropriate level of reserves needed to protect against these risks.

The establishment of reserve funds is essential to ensure that there are adequate funds available to cover potential claims and liabilities. These reserves act as a financial cushion, providing stability and security to the self-insurance plan.

Last Word

In conclusion, self-insurance offers a path to financial independence and flexibility, but it requires careful planning and risk assessment. By understanding the fundamentals of self-insurance, individuals and businesses can make informed decisions to protect their assets and future.

Questions Often Asked

What are the benefits of self-insurance?

Self-insurance provides greater control over coverage, potential cost savings, and more flexibility in tailoring insurance plans to specific needs.

How is self-insurance different from traditional insurance?

Self-insurance involves setting aside funds to cover potential losses, while traditional insurance involves paying premiums to an insurer for coverage.

What industries commonly practice self-insurance?

Large corporations, healthcare providers, and transportation companies are among the industries that often opt for self-insurance.

What considerations are important when deciding to self-insure?

Factors such as financial stability, risk tolerance, and regulatory requirements should be carefully evaluated before choosing self-insurance.

How can a self-insurance plan be effectively managed?

Effective management involves regular risk assessment, creating reserve funds, and staying informed about changes in the industry and regulations.