Travel Insurance with Covid Cover: Everything You Need to Know

Travel insurance with covid cover sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset.

As we delve deeper into the world of travel insurance with Covid cover, we uncover the essential aspects that every traveler should be aware of.

Overview of Travel Insurance with Covid Cover

Travel insurance with Covid cover is a type of insurance that provides protection for travelers against unexpected events related to the Covid-19 pandemic. It is essential for travelers to have this coverage to ensure they are financially protected in case of cancellations, medical emergencies, or other issues that may arise during their trip.Having travel insurance with Covid cover offers several benefits, including coverage for trip cancellations due to Covid-related reasons, reimbursement for medical expenses if the traveler contracts Covid-19 during their trip, and assistance with emergency medical evacuation.

This type of insurance provides peace of mind to travelers, knowing that they have financial protection in case their travel plans are disrupted by the pandemic.In situations where having travel insurance with Covid cover can be beneficial, imagine a scenario where a traveler tests positive for Covid-19 just before their trip and needs to cancel their travel plans.

Without insurance, they may lose a significant amount of money on non-refundable bookings. However, with travel insurance that includes Covid cover, they can file a claim to recoup their expenses and potentially reschedule their trip for a later date.

Coverage Details

Travel insurance with Covid cover typically includes reimbursement for the following expenses related to Covid-19:

Emergency Medical Expenses

- Coverage for medical treatment and hospitalization due to Covid-19 infection while traveling.

- Reimbursement for Covid-19 testing and treatment costs during the trip.

Trip Cancellation or Interruption

- Refund for prepaid and non-refundable trip expenses if the traveler contracts Covid-19 before departure.

- Coverage for trip interruption if the traveler tests positive for Covid-19 during the trip.

Quarantine Expenses

- Reimbursement for additional accommodation and meal expenses incurred due to mandatory quarantine related to Covid-19.

- Coverage for additional transportation costs if the traveler needs to extend their stay due to quarantine requirements.

Emergency Evacuation

- Assistance and coverage for emergency medical evacuation to the nearest adequate medical facility in case of severe Covid-19 symptoms.

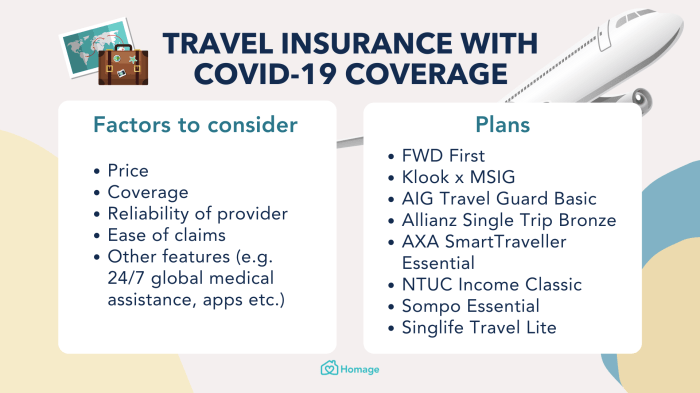

Provider Comparison

When comparing different insurance providers for Covid-related coverage, travelers should consider factors such as the maximum coverage limits, specific exclusions, and the policy's terms and conditions. Some providers may offer more comprehensive coverage for Covid-related issues, while others may have limitations on certain expenses.

Limitations and Exclusions

Travelers should be aware of limitations and exclusions when it comes to Covid cover in travel insurance policies. Common exclusions may include pre-existing medical conditions related to Covid-19, non-essential travel to high-risk areas, and failure to follow government travel advisories or regulations.

It is essential to carefully review the policy details to understand what is covered and what is excluded regarding Covid-related expenses.

How to Purchase Travel Insurance with Covid Cover

When it comes to purchasing travel insurance with Covid cover, it's essential to follow a few key steps to ensure you have the right coverage for your trip. Here is a step-by-step guide on how travelers can purchase insurance with Covid cover and what to consider in a policy:

Research and Compare Policies

Before purchasing travel insurance with Covid cover, take the time to research and compare different policies. Look for policies that specifically mention coverage for Covid-related issues such as trip cancellations or medical expenses related to the virus.

- Check if the policy includes coverage for Covid-related trip cancellations or interruptions.

- Look for coverage for emergency medical expenses related to Covid while traveling.

- Compare the coverage limits and exclusions of different policies to find the best fit for your needs.

Purchase Your Policy

Once you have found a policy that meets your requirements, you can purchase it online through the insurance provider's website or through a travel agency. Make sure to carefully review the policy details and understand the coverage it provides for Covid-related issues.

- Fill out the necessary information accurately and make the payment to secure your policy.

- Keep a copy of your policy documents and contact information for the insurance provider handy during your trip.

Filing a Claim for Covid-related Issues

In the unfortunate event that you need to file a claim related to Covid while traveling, it's essential to follow the correct procedure to ensure a smooth process. Here are some tips on filing a claim for Covid-related issues:

- Contact your insurance provider as soon as possible to report the issue and initiate the claims process.

- Provide all necessary documentation, such as medical reports, receipts, and proof of expenses related to the Covid issue.

- Cooperate with the insurance provider and follow their instructions to expedite the claims process.

Travel Restrictions and Covid Cover

Travel restrictions due to Covid have a significant impact on travel insurance coverage. These restrictions can affect the validity of Covid cover in travel insurance policies, depending on the regulations in different countries. It's important to understand how travel restrictions can influence the coverage you have in place.

Impact of Different Countries’ Regulations

- Some countries may require travelers to have specific Covid cover in their travel insurance policies in order to enter.

- Other countries may not recognize certain types of Covid cover, leading to potential gaps in coverage during your trip.

- It's essential to review the regulations of your destination country to ensure that your travel insurance with Covid cover meets the necessary requirements.

Necessity of Covid Cover for All Types of Travel Destinations

- While Covid cover is crucial for international travel to countries with strict regulations, it may also be beneficial for domestic travel.

- Even within your own country, you may encounter unexpected travel restrictions or cancellations due to Covid, making Covid cover valuable for all types of travel destinations.

- Having comprehensive travel insurance with Covid cover can provide you with peace of mind and financial protection against unforeseen circumstances related to the pandemic.

Last Recap

In conclusion, understanding the nuances of travel insurance with Covid cover can truly make a difference in your travel experience. Be sure to explore your options and choose a policy that provides the necessary protection for your journeys.

FAQ Compilation

Is Covid testing covered by travel insurance with Covid cover?

Yes, most travel insurance policies with Covid cover include coverage for testing expenses.

Can I get a refund if my trip is canceled due to Covid-related reasons?

Refund policies vary among insurance providers, so it's essential to check the terms and conditions of your policy.

Does travel insurance with Covid cover apply to domestic travel?

Yes, many insurance plans extend coverage to both domestic and international travel.